All Categories

Featured

State Ranch representatives offer every little thing from home owners to auto, life, and various other prominent insurance coverage items. State Ranch uses universal, survivorship, and joint universal life insurance policy plans - nationwide indexed universal life insurance.

State Farm life insurance is usually traditional, using stable choices for the typical American family. If you're looking for the wealth-building possibilities of global life, State Farm does not have affordable options. Read our State Ranch Life Insurance policy evaluation. Nationwide Life Insurance Coverage offers all kinds of universal life insurance policy: universal, variable global, indexed universal, and universal survivorship policies.

It does not have a strong visibility in other financial products (like universal strategies that open the door for wealth-building). Still, Nationwide life insurance policy plans are highly easily accessible to American households. The application procedure can also be extra manageable. It helps interested parties get their first step with a reliable life insurance coverage strategy without the a lot more complicated conversations regarding investments, monetary indices, and so on.

Nationwide fills the important role of obtaining reluctant purchasers in the door. Even if the worst happens and you can not obtain a larger strategy, having the security of a Nationwide life insurance policy plan might transform a purchaser's end-of-life experience. Read our Nationwide Life insurance policy testimonial. Insurance coverage business make use of clinical exams to evaluate your danger course when looking for life insurance.

Customers have the choice to change rates monthly based on life conditions. Of program, MassMutual offers exciting and potentially fast-growing chances. These strategies often tend to do best in the long run when early down payments are greater. A MassMutual life insurance coverage agent or financial advisor can assist purchasers make strategies with room for adjustments to satisfy short-term and long-lasting monetary goals.

Death Benefit Option 1

Review our MassMutual life insurance evaluation. USAA Life Insurance Policy is understood for supplying budget friendly and thorough monetary items to armed forces participants. Some buyers may be stunned that it uses its life insurance policy policies to the public. Still, armed forces participants appreciate unique benefits. As an example, your USAA policy features a Life Event Choice rider.

If your policy doesn't have a no-lapse warranty, you might also lose protection if your money worth dips below a certain threshold. It might not be a terrific option for individuals that simply desire a death benefit.

There's a handful of metrics through which you can evaluate an insurance business. The J.D. Power customer contentment score is an excellent choice if you desire an idea of exactly how clients like their insurance policy. AM Ideal's economic toughness ranking is one more vital statistics to think about when selecting an universal life insurance company.

This is specifically important, as your cash money worth grows based on the investment choices that an insurance provider uses. You should see what investment choices your insurance policy company deals and compare it versus the objectives you have for your policy. The very best way to locate life insurance policy is to gather quotes from as numerous life insurance firms as you can to recognize what you'll pay with each policy.

Latest Posts

New York Life Universal Life

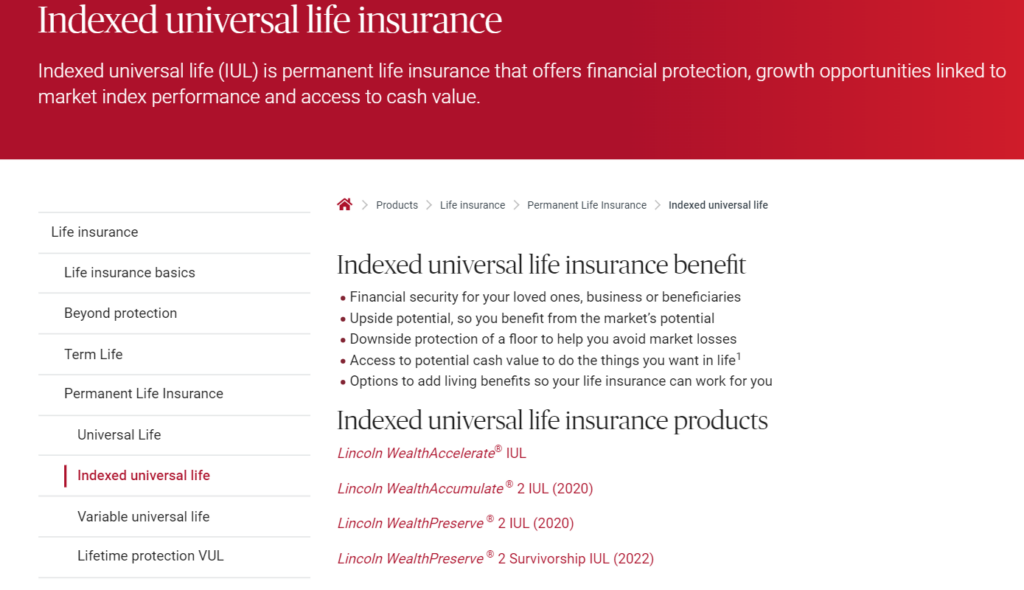

Indexed Universal Life Insurance Policy

Eiul Policy